My name is Robynne Ikesaka, I have a Bachelors of Emergency and Security Management from the Justice Institute of British Columbia (JIBC) and until recently I have been working for a municipality in northern Alberta as an emergency coordinator. I left to pursue a more creative career but I wanted to infuse my love and passion for emergency management into Beautifully Wander.

My goal here is to break down building.a crisis preparedness program into manageable chunks and help you small business owners and creators create a more resilient business so you can continue doing what you love and the disasters of today impact you a little less!

Tune in every Wednesday on YouTube for some tips on building your business crisis preparedness program.

Just as you have a business plan, marketing strategy, projects to improve your business, and thought-out processes for booking clients, invoicing clients, balancing the books, you should have plans, projects and thought-out processes for your business crisis preparedness program.

The program designed to help you prevent and mitigate risks to your business and navigate the impacts when they do hit - no matter what your business is and what size your business is!

Local Retail Owner (sell soaps, candles, mugs, clothes, etc.,)

Small Restaurant

Photographer

Videographer

Graphic Designer

Etc.

COVID-19 has likely inserted some sort of personal or professional challenge in your life. For small business owners you might have experienced:

Employment loss and retention

Store closures

Financial loss

Lost clients

Reputation damage

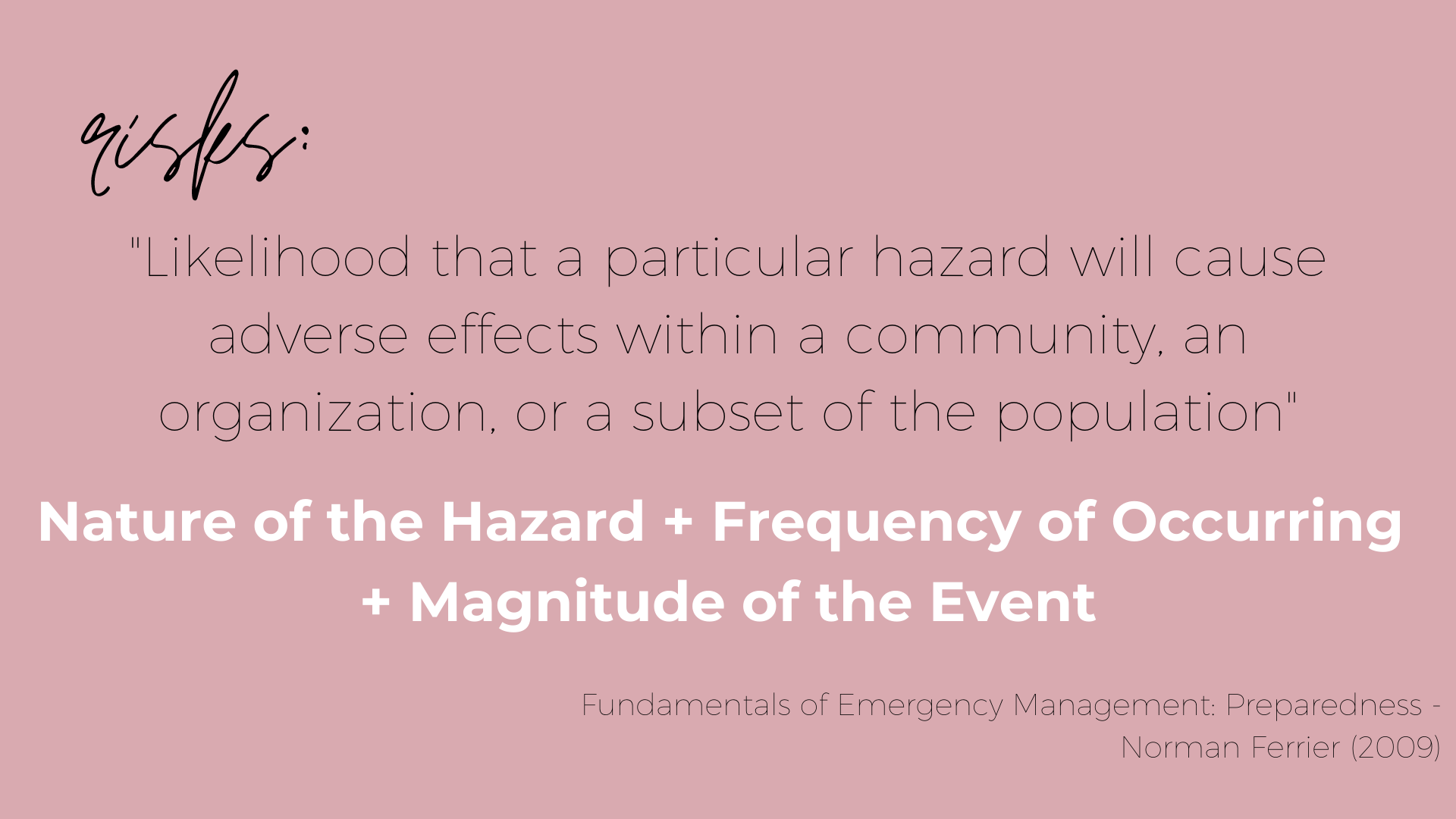

Every business is subjected to some hazards and risks:

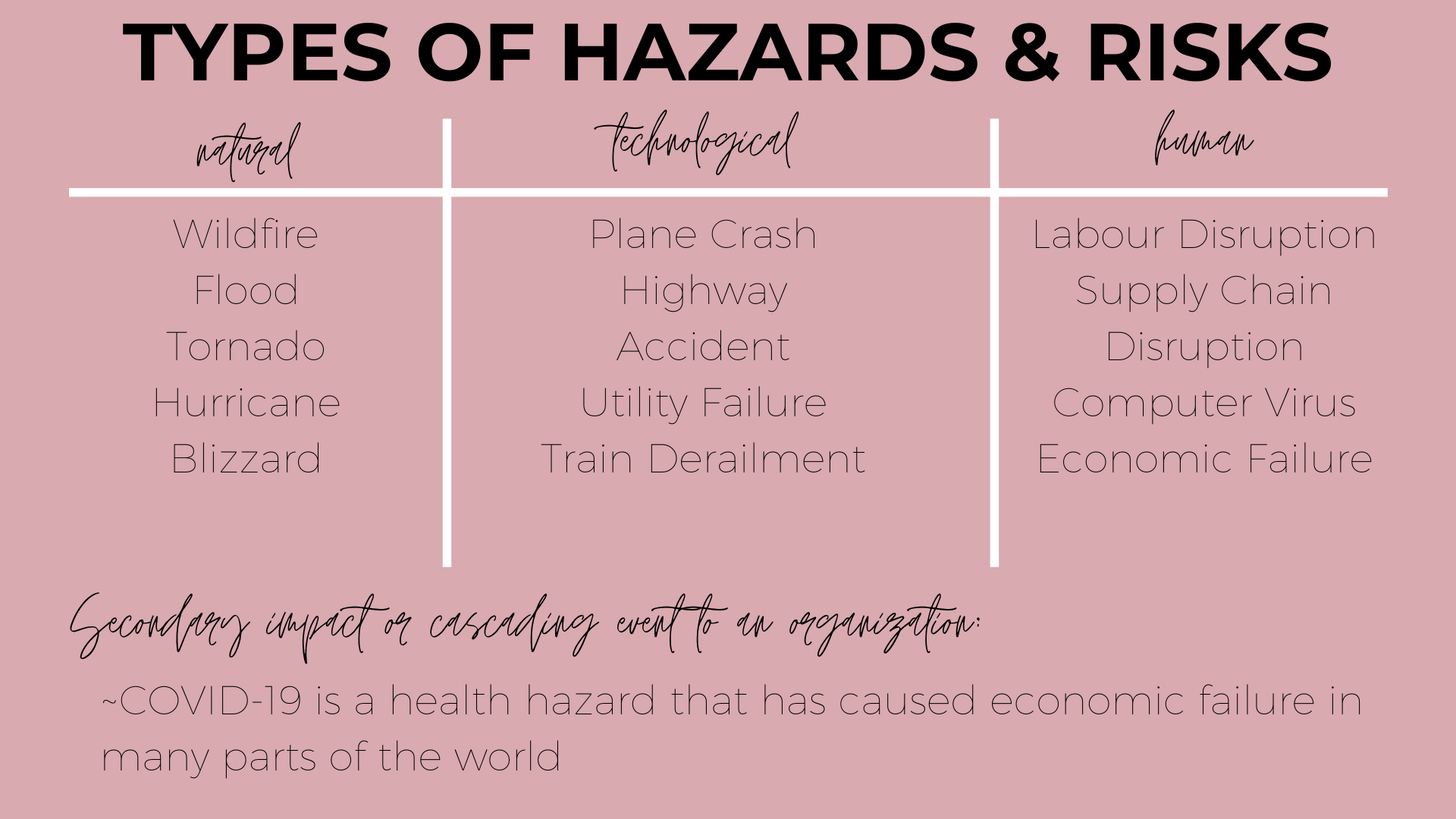

There are three very broad categories of hazards - natural, technological and human-caused:

Now, there are many beliefs that people hold on to on why they don’t have a crisis preparedness program. However, getting prepared, taking the steps, thinking ahead, and having these conversations will help your business survive and maybe thrive during and after.

Here are 3 examples that emphasize the importance of having a crisis preparedness program for your business!

Example #1

When I was living in Fort McMurray there was a local camera store that was located in Lower Townsite. Lower Townsite in Fort McMurray is in a flood plain (located between the Athabasca River and the Clearwater River) so they have a high likelihood of flooding.

Like any retail store they had camera inventory everywhere.

A common recommendation that a municipality will give to residents that live in a flood plain is to raise their belongings (don’t keep things on the floor or the bottom shelves). This recommendation can apply for businesses as well - raise your inventory.

A couple months ago some areas of Fort McMurray experienced a really bad flood and this shop had lost thousands of dollars of inventory because a lot of their inventory was on the floor and the bottom shelves.

Takeaway: If they had planned, budgeted and invested in a mitigation project (re-organizing the store, or buying/building new shelves) for their business they would have reduced their risk to flooding (a known risk for that location) and they wouldn’t have experienced as much of a financial loss then they did.

Example #2

During COVID-19 I was following how the pandemic was affecting small businesses and I read about how a store-front jewellery store was struggling to make it through because they couldn’t allow customers to shop. Thus, during COVID-19 the owner was working on a website so she could sell her inventory online.

A potential project for that businesses crisis preparedness program could have been developing the website ahead of time. They are not only expanding how they do business but if based on their hazards and risks it would have created a redundant system that helped them maintain businesses during times like this.

Takeaway: Understand the risks to your business, always have a Plan A, B and C, figure out what you can mitigate, identify what you need to do to prepare for when it happens, and figure out how you can create redundancy for your business.

Example #3

For many people and businesses COVID-19 has caused some financial strain.

A common recommendation municipalities will give to their residents is to have an 3-6 month emergency fund or rainy day fund.

Basically, if you were out of work for 3-6 months or if you had unexpected emergencies pop up the emergency fund will help cover you.

This recommendation can apply to businesses as well.

Figure out what your expenses are and come up with a plan to create a nest egg that will help cover you during emergencies.

Photographers, if you have $1000 worth of business expenses and $2000 worth of personal expenses a month you need to consider saving $9,000 - $18, 000.

Takeaway: Coming up with the money isn’t going to be immediate and how much and how you come up with the money is entirely up to you and is different for everyone but build a cushion that will help save you during emergencies.

These are three examples of how investing in a business crisis preparedness program is important and can save you time, stress and financial loss.